The 5-Second Trick For Fredericksburg bankruptcy attorney

It's a location of exercise that intersects with a number of other lawful issues on regular basis. Not a lot of attorneys exercise bankruptcy, and when a bankruptcy associated challenge will come up, Scott is often willing to share his insights when other attorneys have inquiries. Scott joined the Manassas Legislation Group in 2003,...

Enable’s commence by defining what we imply by a “complete checklist” of creditors. Within a bankruptcy situation, a listing of creditors incorporates all of the persons or companies to whom you owe cash or have any money obligations. This contains credit card providers

You may talk to the court to Allow you to shell out the cost in monthly installments. You have to pay back an Preliminary bare minimum degree of 25% on the submitting fee inside of thirty times of filing the petition. Following that, you pay out regular monthly installments of no a lot less than 25% from the filing charge.

But You cannot discharge all debts. You will need to be sure that bankruptcy will discharge (remove) ample expenditures to really make it worthwhile.

You can e mail the internet site owner to let them know you had been blocked. Please consist of Whatever you ended up accomplishing when this website page arrived up plus the Cloudflare Ray ID uncovered at The underside of the page.

Stage 1 – Acquire Files – Collect your fiscal files making sure that both you and your attorney can evaluation your debts and also your In general economical wellness and explore whether or not a bankruptcy filing is suitable. This really is step one in the method.

A report from the Federal Reserve Bank of Philadelphia identified that only one-third of Chapter 13 bankruptcy conditions cause discharge. This figure arises from a number of reports in numerous districts check out this site all through the U.

Secured debts are Individuals backed by some sort of collateral. In the situation of the property finance loan, for instance, the home by itself generally serves as collateral. That has a car or truck personal loan, it's usually the car. Every time a financial debt is secured, the creditor includes look at this site a right to seize the collateral Should the financial debt goes unpaid.

Stage 4 – File Bankruptcy Petition – Your Fredericksburg bankruptcy attorney will file a bankruptcy petition with accompanying kinds listing your earnings and expenses. When you've got completed filing the petition and saying your exempt residence, an automatic keep goes into outcome Your Domain Name and prevents creditors and assortment agencies from pursuing credit card debt collection attempts from you, such as foreclosure proceedings, eviction, repossession of cars and garnishment of wages. The remain will keep on being in outcome whilst the bankruptcy is pending.

This read more may be a fantastic place to begin as most of the debts will likely demonstrate up in your credit history report. Nonetheless, if you’re beneath time tension, it’s greatest to ask for the reviews by mail since it can take around ten days to obtain them by way of the web site.

Bankruptcy legislation recognize that you ought to be permitted to keep sure home in Chapter 7 bankruptcy. This home is safeguarded as a result of exemptions. Exemptions shield all types of genuine and personal assets as much as a specific amount of money. Individual house contains appliances, garments, books, and jewelry.

Individuals and married partners, even if self-utilized or operating an unincorporated business enterprise, are qualified to file for Chapter thirteen bankruptcy. Here's how Chapter thirteen works, Together with how it compares with other sorts of bankruptcy.

Chapter 13 bankruptcy is meant to aid folks whose debts are uncontrolled but who make plenty of funds to repay their debts partly, or in full.

Step 2- Evaluate Selections – Your attorney will Assess what sort of bankruptcy is appropriate. There's two sections on the federal bankruptcy code, official statement Chapter seven and Chapter 13, which are utilized for filing particular bankruptcy depending upon the person conditions. A Chapter seven bankruptcy, at times often called straight bankruptcy, involves the sale of non-shielded property to pay back as much personal debt as you possibly can and makes it possible for a debtor to own most debts dismissed like charge card financial debt and medical costs. It is obtainable for people who don't have frequent profits to pay their obligations.

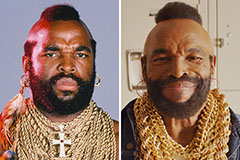

Mr. T Then & Now!

Mr. T Then & Now! Shane West Then & Now!

Shane West Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now! Lacey Chabert Then & Now!

Lacey Chabert Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!